About Taxera

- home

- About Taxera

About us Taxera

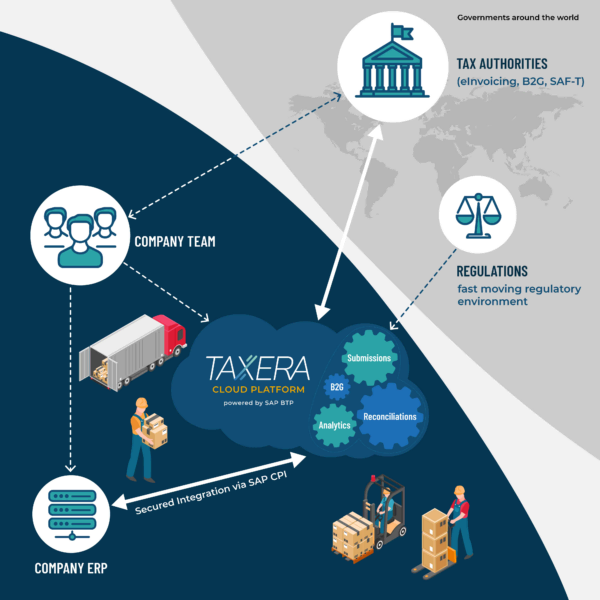

Introducing Taxera Technologies, a pioneering cloud-based SaaS platform focused on revolutionizing tax compliance for multinational organizations. Our mission is to future-proof your tax function by digitizing every aspect of taxation, from indirect tax to statutory reporting.

As the digital tax landscape experiences a massive shift worldwide – spanning from Italy to Australia, Colombia to Dubai, and beyond – governments are continuously implementing new tax models that significantly impact the daily operations of most businesses.

Recognizing that passive approaches to taxation are no longer sufficient, authorities are introducing innovative measures to enhance transparency in data collection. In some regions, non-compliance can even lead to the real-time shutdown of operations.

Exceptional service. Worldwide.

Our vision

At Taxera Technologies, our vision is to revolutionize the global indirect tax compliance landscape through cutting-edge, cloud-based solutions. We aspire to empower businesses of all sizes to navigate complex tax regulations with ease, efficiency, and accuracy. By fostering innovation and leveraging the latest technological advancements, we strive to create a future where tax management is seamless and accessible for all. Our unwavering dedication to client success fuels our mission to become the foremost leader in the digital tax compliance industry.

Our Mission

At Taxera Technologies, our mission is to transform the way businesses handle global indirect tax compliance by providing innovative, cloud-based solutions. We are dedicated to simplifying complex tax regulations and processes, enabling organizations to focus on their core objectives. Our commitment to delivering exceptional client experiences drives us to continually evolve and improve our platform. Through our passion for technology and excellence, we strive to make tax management seamless, efficient, and reliable for businesses worldwide.

The features of taxera

eInvoicing / eReporting / SAF-T / Continuous Transaction Control

Tax Data Reconciliation Cockpit

VAT Submissions Cockpit

Over 50 satisfied multinationals trust Taxera

Taxera Technologies has extensive experience managing global indirect Tax Technology projects, with a track record of successful outcomes for more than 50 satisfied clients. We tailor our approach to meet the specific needs of each organization and take pride in delivering exceptional results. Count on Taxera to help your business thrive and succeed by navigating the complexities of global tax regulations.