Tax Technology for the Digital Era

Next Generation Global Tax Compliance platform for multinationals all on one powerful enterprise-grade hub in the Cloud and continuously updated with the latest tax regulations around the world.

Embrace seamless Integration with any major ERPs, run your global eInvoicing, SAF-T, Pillar 2 projects from a single cockpit and automate manual team tasks such as Reconciliation and VAT Reporting.

Play Intro

Our Clients are global and in all industry types

Enterprise-grade Platform

Built on SAP BTP Business Technology Platform: Experience a scalable, robust, and secure cloud solution with ISO 27001 certification, designed for seamless integration with all major ERPs to elevate your business performance.

Global Coverage

Reduce your risk exposure and increase your Indirect Tax compliance Technology coverage from one single platform already connected to Tax Authorities around the world. The platform lets you choose the Datacenter location where you will want your data to be processed.

NEXT-GEN INTEGRATION

Seamlessly integrate your Systems to tax authorities, suppliers, clients with Taxera advanced Cloud Platform Integration. Secure end-to-end connectivity with no code on your system, no Excel files or downloads required.

RELY ON TAXERA

Crafted by industry veterans: Ex-Novartis Global Head of ERP, Bacardi IT Finance Director. Our strategic local Big4 partnerships ensure your business benefits from continuous updates and unwavering compliance with the latest global regulations.

Intelligent Tax in the Cloud, Be Ahead of the Curve

Taxera is a leading tax technology platform that enables multinationals to manage their global tax compliance operations from a single cloud-based platform. Our comprehensive suite of applications includes eInvoicing, eReporting, SAF-T, Tax data reconciliation, VAT submission, Pillar 2 BEPS, and deep embedded analytics.

Taxera’s platform integrates seamlessly with major ERP systems (such as SAP, Oracle, Dynamics, etc.) and is connected in real-time to Tax Authorities around the world. As a Swiss-based company, we are committed to providing our clients with exceptional service and expertise in tax compliance to help them streamline their operations and achieve global tax compliance effortlessly.

The Saas platfrom is meticulously engineered with a focus on full GDPR compliance and the prioritization of our clients’ data privacy. We provide the flexibility to choose the country, data center, and hyperscaler that will handle your data processing, granting you absolute control and assurance for your data protection needs.

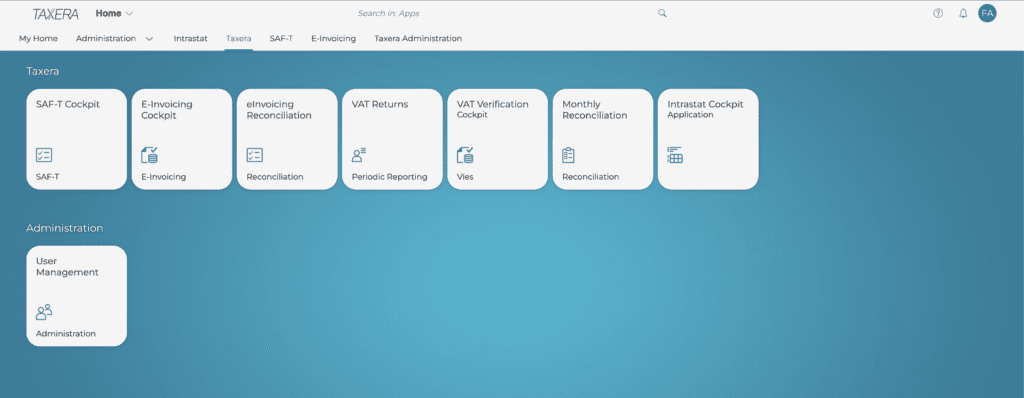

Enjoy a user-friendly cockpit for all your Tax compliance activities

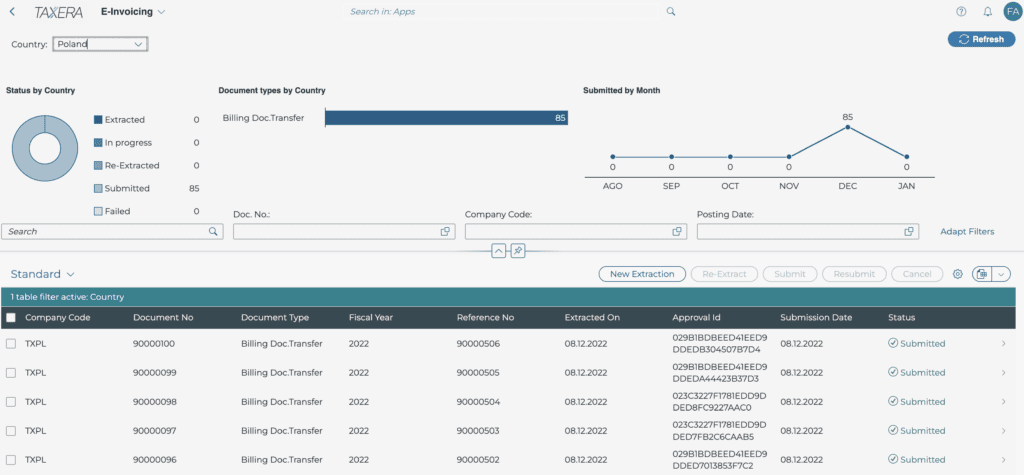

eInvoicing in full compliance with global standards

A single global platform utilizing cutting-edge technology, capable of processing vast amounts of data in various structured invoice formats like EN16931, UBL, XML, Factur-X, ZUGFeRD, CII, EDIFACT, and more. Learn more about our e-Invoicing offering

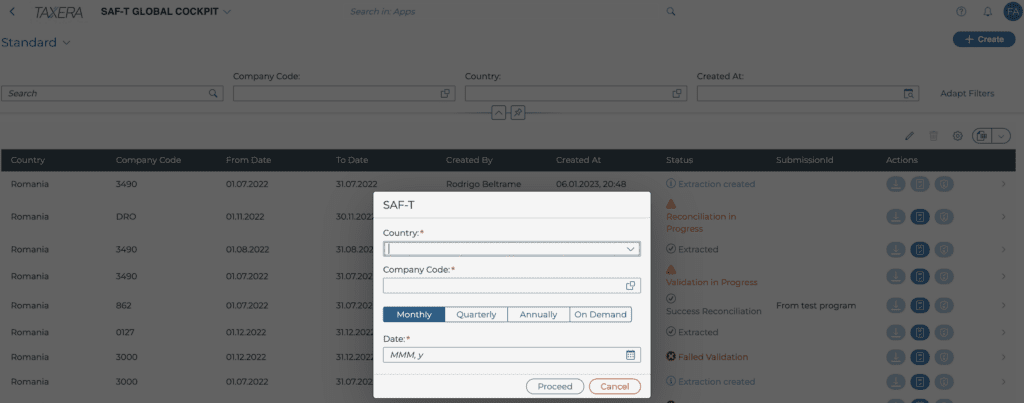

Prepare, produce, and submit your SAF-T in full confidence

Leverage Taxera for crucial SAF-T needs, with accounting and tax data reported periodically or as required. Our unified global platform streamlines SAF-T & eReporting obligations, ensuring confident tax data submission and seamless accounting information management. Learn more about our SAF-T solution

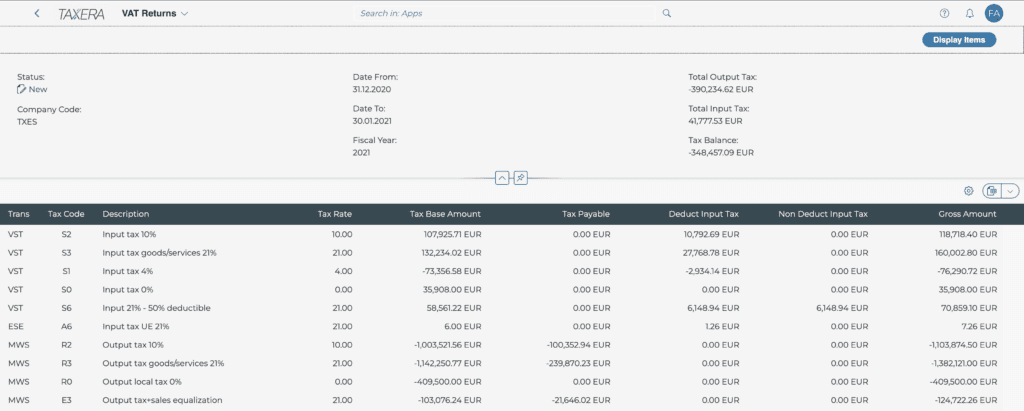

Simplify, digitize and automate your VAT Reporting

Use Taxera’s cloud solution to automate, centralize, and standardize the preparation, reconciliation, amendment, and validation of VAT reports for tax authorities worldwide, mitigating the risks and costs of compliance. Learn more about our VAT Returns offering

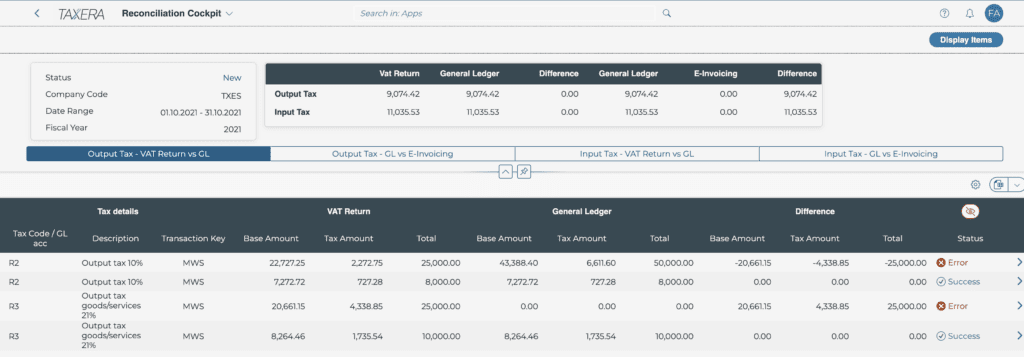

Automatically eReconcile your Financial Datas

By using Taxera’s drill-down capabilities and reconciliation cockpit, companies are now able to reconcile their data, both output tax and input tax with their financial statements and eInvoicing data in real time. Learn more about our eReconciliation solution.

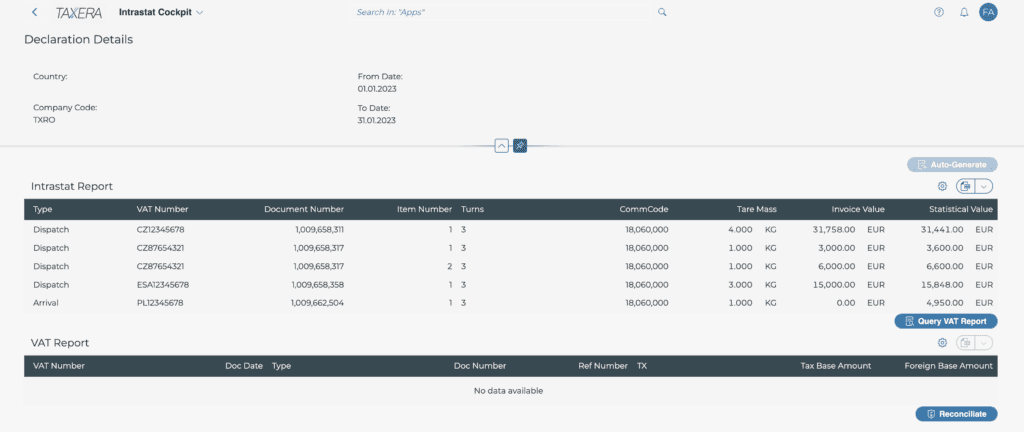

Manage effortlessly your Intrastat & EC Sales List

Our platform offers automated reporting and full drill-down capabilities, allowing businesses to identify and reconcile discrepancies quickly and accurately. Learn more about our Intrastat offering

Who we are

Solutions for efficient management of global tax operations

At Taxera, we offer you the tools you need to stay agile and stay ahead of constantly changing tax and regulatory rules, no matter how many countries you do business in. With our unique tax compliance platform, you have access to all the resources you need to keep up with changes in real time. With Taxera, you can be sure to meet all tax obligations while maximizing your performance.

Powerful tax compliance solutions for businesses of all sizes

To meet today’s tsunami of highly disruptive and ever growing government legislation, Taxera’s platform helps manage your eGovernment needs end to end.

GLOBAL COVERAGE

Create Your Own Global Tracker

Why Taxera ?

What makes Taxera the best choice?

Experience the future of tax compliance with Taxera, where cutting-edge technology meets unparalleled expertise to deliver seamless, efficient, and tailored solutions for your global business needs.

Choose Taxera and simplify your tax compliance journey with confidence.

Achieve your next steps of digital transformation

The taxera platform helps you cope with the current tsunami of highly disruptive and ever-increasing government legislation.

Latest Publications

We are dedicated to staying ahead of the curve and sharing our expertise with the community. Our team continuously publishes insightful articles to keep our clients and industry professionals informed about the latest trends, best practices, and developments in tax compliance and related fields.

Taxera partners with Amadeus to bring eInvoicing technology to partners…

Travel technology company Amadeus has signed a new…

10 key watchouts that companies affected by the Australian e-Invoicing…

1. Compliance Businesses need to ensure that they…

Over 50 satisfied multinationals trust Taxera

Taxera Technologies has extensive experience managing global indirect Tax Technology projects, with a track record of successful outcomes for more than 50 satisfied clients. We tailor our approach to meet the specific needs of each organization and take pride in delivering exceptional results. Count on Taxera to help your business thrive and succeed by navigating the complexities of global tax regulations.