Enterprise Grade Platform

- home

- Enterprise Grade Platform

We solve the global indirect tax challenge with an end to end ITX solution

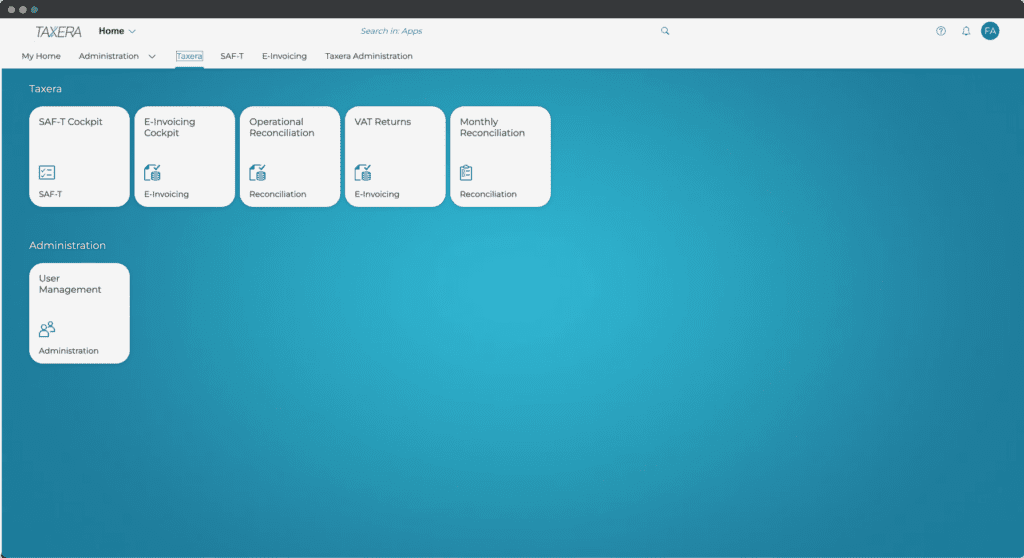

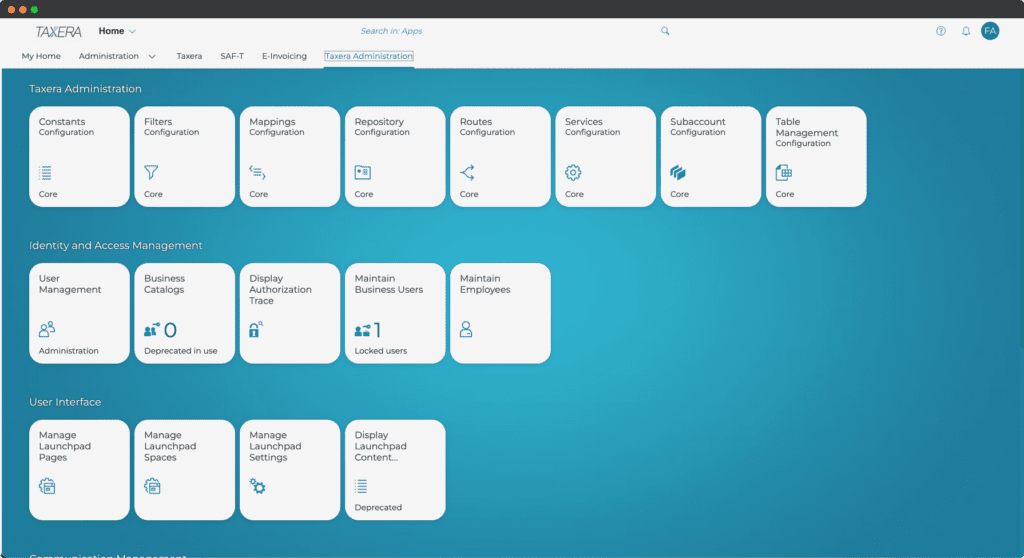

Manage your indirect tax global obligations from one platform

Shift from a local point-to-point tactical solution to a single global platform, simplifying your business processes and IT architecture. Easily switch between apps and countries.

Deploy easily

Deploy within weeks not months with zero code installed on your system and no impact on your business process and IT landscape. You benefit from legal and technical updates done on a permanent basis.

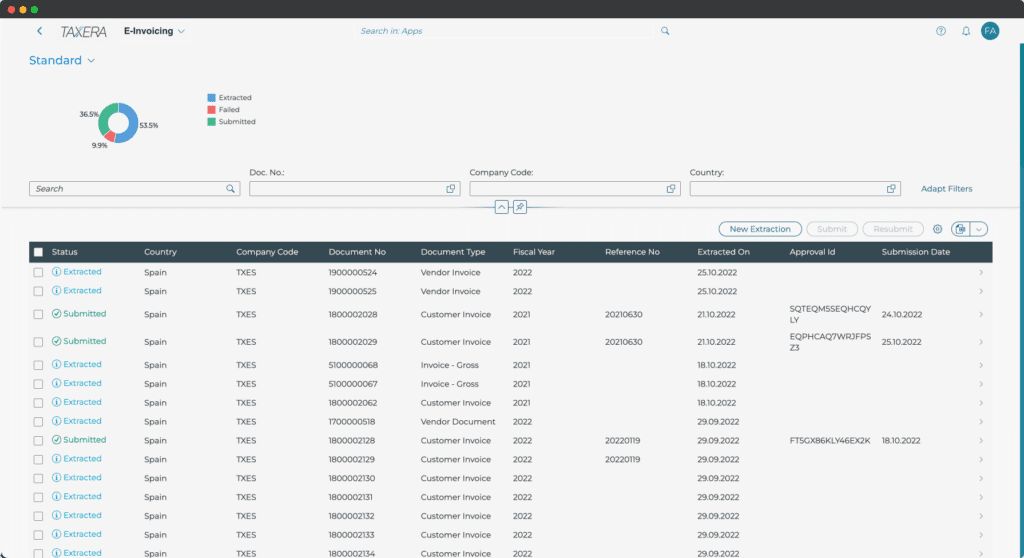

Integrate in a seamless manner

The solution provides a seamless integration from client ERP to the tax authorities with modern API. This will allow you to enjoy the end-to-end integration and the data flowing between your ERP and the tax authorities and back to your system.

Scale with confidence

Scale and easily add countries to your Indirect Tax compliance platform; You can decide to use additional App functionalities such as Data Reconciliation, SAFT, eInvoicing or VAT Submissions once to maximise your ITX experience.

Enjoy the power of a full SaaS

The platform is built for speed, simplicity and scalability. Everything is included in the offering such as integration, project management, support, constant legal updates.

Enjoy a modern UI

Manage your global tax compliance

Manage your Indirect tax compliance from a single cockpit

Taxera Platform

Technical Information

- Solution Types : Extensions and Add-ons

- Works With : SAP S/4 HANA

- Category : ERP and Finance/ SAP S / 4HANA

- Cloud Solution This product is designed to be delivered over a network as a cloud service

- Integrates with SAP Cloud solutionsThis product integrates with SAP cloud solutions using standard SAP-approved interfaces and APIs

- Software-as-a-Service solutionThis product is delivered online as a subscription service.

- User Assistance providedAssistance is provided to enable all target users to install configure, and use the solution.

- Service Levels >99.5%This product achieves operational performance levels of 99.5% or greater.

- Multi-tenant solution with full isolation and encryptionThis product utilizes a multi-tenant architecture with complete isolation and encryption of customer account data, policy and configuration settings.

- Auditable logging and tracingThis product offers auditable logging and tracing capabilities to aid in debugging and troubleshooting.

- High availability and disaster recoveryThis product has been designed to ensure minimal service interruption and quick restoration of service in the event of a disruption.

- Meets recommended data lifecycle management standardsThis product meets SAP Store-recommended standards for data lifecycle management and data destruction.

- Meets SAP Store recommended Service LevelsThis product meets SAP Store-recommended service levels.

- Meets recommended support levelsThis product meets SAP Store-recommended standards for support levels and turnarounds.

- Follows the secure software development and operations lifecycle (SDLC)Secure practices include design, architecture, implementation, test, release preparation, shipment, operations, and support. Open-Source components run latest version.

- Disaster Recovery capabilities in place for products where contractual commitments existDR Plans are documented, available and tested regularly to ensure contractual agreements for RTO, RPO, MTPD are followed.

- Provides encrypted communication connectionsCryptographic protocols and algorithms with strong keys are used to protect and encrypt sensitive data whether persistent or transferred via any channel.

- Enforced with international or industry standard configurable authentication policiesCredentials are protected during transfer by secure channels or protocols. Any mechanisms provided for authentication are sufficiently strong and free of vulnerabilities.

- Maintains a thorough product incident response and patching processDelivers fixes and/or advisories related for security vulnerabilities publicly known or reported by external sources.

- Regularly scans Product for vulnerabilities and patches based on industry requirementsRegularly scans static code and open-source components for vulnerabilities, and at a minimum, patches according to CVSSv3 or industry required standard.

- EU GDPRThis product complies with European Union requirements for GDPR.

- SOC2 Type2 (Security, Availability, Confidentiality, and Privacy)This product meets the standards for information security management specified by SOC2 Type2, covering the principles of Security, Availability, Confidentiality, and Privacy.

- Functional correctnessThis product has been tested for functional correctness using real-life business scenarios of customers.

- ISO 27001 (Information Security Management)This product meets the standards for information security management specified by ISO 27001.

- EU data privacyThis product complies with European Union requirements for data privacy.

- Offers EU access onlyTo comply with data protection regulations, this solution restricts remote data access and data storage to countries that have implemented the EU Data Protection Directive.

- Localized for business best practicesThis product has been localized to incorporate local business best practices (e.g. support for local currencies).

- Internationalized for global customersThis product has been internationalized to meet the needs of global customers (e.g. the use of Unicode).

- Translated user interfaces and documentationUser interfaces and documentation for this product have been translated into multiple languages.